Green Affordable Housing Finance

Reall’s Green Affordable Housing Finance platform accelerates the development of green, affordable housing finance ecosystems across Africa and Asia that are self-sustaining and locally driven.

The platform is an innovative market-ready solution to the climate crisis which improves the availability of green finance for people on low incomes. If you’re looking to invest in this opportunity, get in touch. To learn about the instrument in detail, read our Instrument Overview and Instrument Analysis.

Looking to invest?

Green Affordable Housing Finance Instrument Overview

Green Affordable Housing Finance Instrument Analysis

The challenges ahead

The built environment currently contributes 37% of global greenhouse gas emissions (GHG); the urban population of Africa and Asia is expected to increase to 4.5 billion by 2050; yet 70% of the buildings that will be needed in Africa and Asia by 2050 have not been built yet. The challenges of the climate crisis and rapid urbanisation are inextricably linked.

With support from the Global Innovation Lab for Climate Finance, Reall is pioneering a financial instrument that aims to address both the climate and the affordability challenges simultaneously.

A ground-breaking model

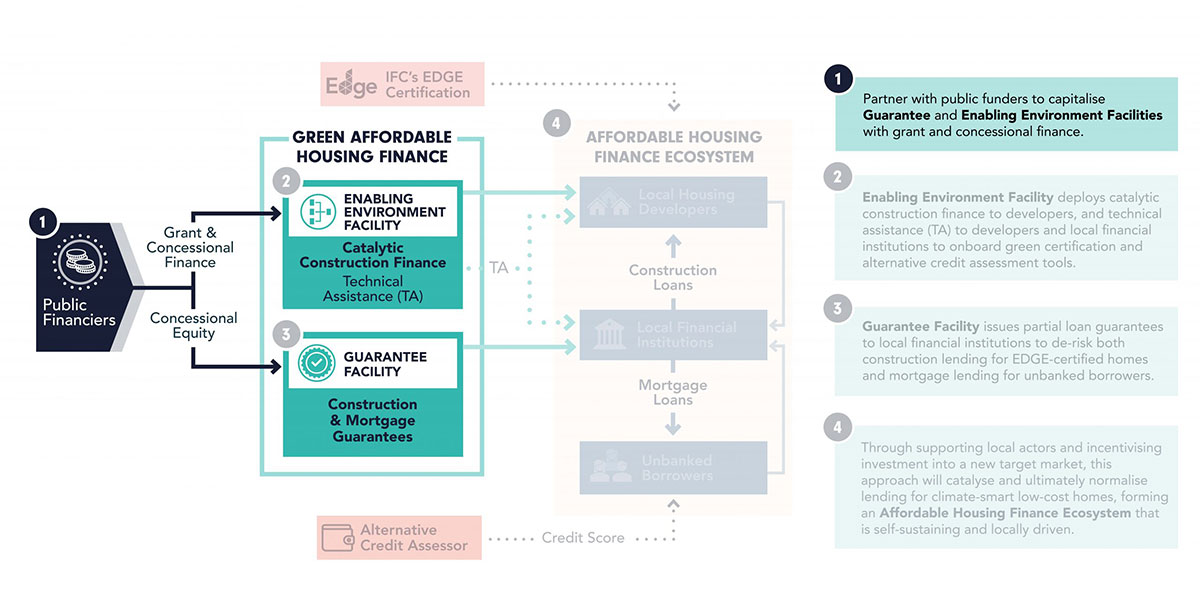

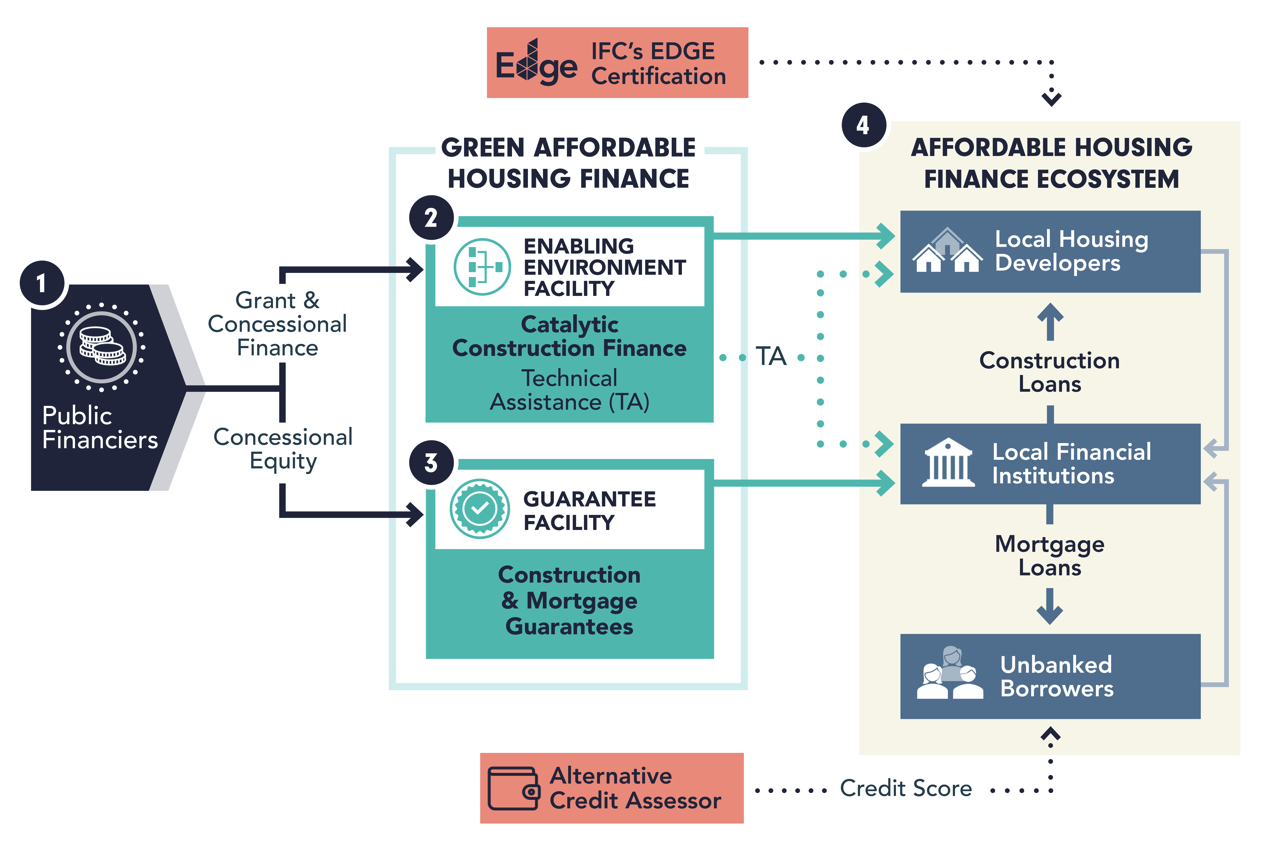

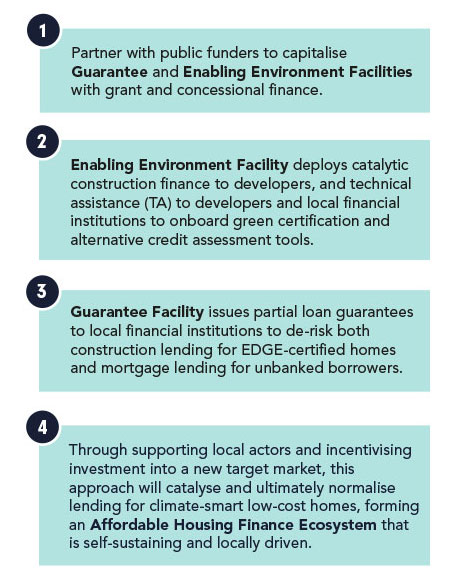

Green Affordable Housing Finance, developed by Reall and endorsed by the Lab, is a green financial instrument designed to foster the adoption of sustainable mortgage lending to low-income earners for green affordable homes.

Instrument mechanics

Pilot in Kenya

Reall will pilot the green finance instrument in Kenya, where the affordable housing market is critically constrained, but where the impact potential is high. With homeownership in Kenya as low as 21%, Kenya exists as a microcosm for the global challenges and opportunities which characterise the green, affordable housing market for climate-smart affordable homes.

Through use of IFC’s EDGE certification, Reall estimates that 30 million tons of CO2e (carbon dioxide equivalent) could be avoided in meeting Kenya’s deficit of two million houses. The pilot will employ technology developed by alternative credit assessor, Syntellect, which has been used to secure 14,000 mortgages for unbanked households in India.

Target geography

Once piloted in Kenya, Reall will launch the model into other markets, boosting available capital for green developers, and expanding homeownership into further untapped markets.

Revolutionising credit-scoring

Syntellect, led by its visionary CEO Sumedha Naik, empowers underserved consumers in the Indian market with innovative credit scoring technologies, creating new pathways to financial inclusion and prosperity. Listen to firsthand accounts from some of these underserved consumers as they share their stories.

News & Resources

Financial Instrument to unlock $400M in green homes

Green Affordable Housing Instrument Gets Stamp of Approval

Fostering a Green Affordable Housing Finance Ecosystem

Reall Wins Prestigious Global Climate Award Programme

CONNECT

WITH US

Lucy Livesley

Governance & External Affairs Director